How your pension is calculated

Minimum and maximum retirement ages

Contributory State Pension (CSP)

Retirement and mid-career planning seminars

Pension contributions

You pay contributions towards your HSE pension and lump sum through your salary. These contributions are shown on your payslip.

PRSI class A

You pay PRSI class A if you were recruited after 6 April 1995.

Your PRSI contributions as an employee in PRSI class A go towards your state pension (contributory). The Department of Social Protection (DSP) pays this pension.

Class A contributions: 3% of pensionable pay, plus 3.5% of net pensionable pay.

PRSI class D

You pay PRSI class D if you were recruited before 6 April 1995.

Your PRSI contributions as an employee in PRSI class D do not go towards or qualify you for a state pension (contributory).The HSE pays your full pension (employees paying PRSI class A receive part of their pension from the HSE and the rest (state pension) from the DSP).

Class D contributions: 6.5% of pensionable pay.

Related content

Pay Related Social Insurance (PRSI) - gov.ie

Getting an estimate

Getting an estimate and pension benefit statements

Pension benefits

- lump sum payment (tax-free up to €200,000)

- monthly pension

- pension benefits for spouses, civil partners, and qualifying dependent children following staff member's death in service or after retirement. This applies if you're a member of the widows' and orphans' pension scheme or spouse and children's pension scheme

Factors that affect pension benefits

- reduced working hours

- unpaid leave (for example, shorter working year, special unpaid leave, unpaid leave for medical care)

- career breaks

- parental leave

- temporary rehabilitation remuneration (TRR)

- injury at work grant

How your pension is calculated

Your pension area office calculates your pension benefits.

HSE Pension Scheme

Your benefits are based on:

- your basic salary, plus

- an average of your best 3 consecutive years of pensionable allowances in the last 10 years, if applicable

- your total pensionable years' service

Single Scheme

Your benefits are based on your career average earnings:

- a monetary amount is banked towards your benefits each pay period

- amounts accumulate annually

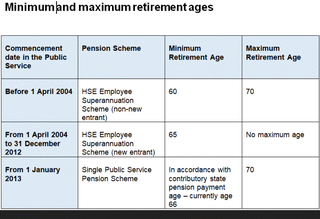

Minimum and maximum retirement ages

The minimum retirement age is the earliest age at which you can start to get your benefits.

Minimum and maximum retirement ages depend on your employment start date in the public sector.

Start date before 1 April 2004

Minimum retirement age is 60. Maximum retirement age is 70.

Start date on or after 1 April 2004 and before 1 January 2013

Minimum retirement age is 65. No maximum retirement age.

Start date on or after 1 January 2013

Minimum retirement age is the same as the state contributory pension (currently 66). Maximum retirement age is 70.

Note: If you resign from the HSE and return after a break of 26 weeks or more, you will become a member of the Single Public Sector Pension Scheme (SPSPS). This applies regardless of the pension scheme you were a member of before resigning. The SPSPS's minimum and maximum retirement ages will apply.

Temporary and permanent contracts

If you were initially hired on a temporary contract, your minimum and maximum retirement ages remain unchanged. This is because your start date is treated the same whether you have a temporary or permanent contract.

How to apply for your pension

You should apply for your pension 3 months before your retirement date.

Fill out the HR107(a) retirement form and HR106 leaving form.

For clear, simple instructions on how to ensure that everything is correct before submitting it, refer to the following video or guide document.

HR107(a) completion guide video

HR107(a) completion guide document

Retirement Form HR107(a) Completion Guide (PDF, 2.5 MB, 25 pages)

Send your completed HR107(a) retirement form to your pension area office.

Your line manager should return your completed HR106 leaving form to your local HR or Personnel Administration department.

Your retirement date is inclusive of any annual leave owing to you. You can only get paid for annual leave owing to you if you are retiring on ill-health grounds. Your local occupational health department will provide a report recommending you retire on ill health grounds, if you meet the criteria.

Contact your pension area office if they have not confirmed your retirement date in writing before you retire.

Pension payments

Your pension area office calculates your pension payment.

Your pension payments cannot be calculated until after your final salary payment. You will receive your pension payment 6 to 8 weeks after your final salary payment.

Pensions are paid monthly, on the last working day of the month.

Payment of arrears

Your first monthly pension payment will include any pension arrears due to you from the date of your retirement.

For example:

- your retirement date is 15 June

- your first pension payment on 31 July would include your pension payment for July, plus pension payment due to you from 16 to 30 June

Contributory State Pension (CSP)

Eligibility and how to apply for Contributory State Pension (CSP) - welfare.ie

Retirement and mid-career planning seminars

Retirement planning seminar

1-day retirement planning seminar to help you plan for your retirement.

Mid-career planning seminar

3-hour seminar to help you plan your future working life in the HSE.

Retirement pack

Get help with every step of the retirement process in the retirement pack.